Blog

Credit Hub Australia – Your Guide To The Home Loan Application Process

Getting a home loan can seem complicated, but understanding the steps involved can make the process much easier. Whether you're… Continue reading Credit Hub Australia – Your Guide To The Home Loan Application Process

How Do You Calculate Stamp Duty Costs In Victoria, Australia?

Struggling to figure out how much stamp duty you'll have to pay when buying property in Victoria, Australia? You're not… Continue reading How Do You Calculate Stamp Duty Costs In Victoria, Australia?

The Ultimate Conveyancing Checklist: A Step-by-Step Guide For Buyers And Sellers

Starting your property journey can be both exciting and overwhelming. From deciding how to own the property to understanding your… Continue reading The Ultimate Conveyancing Checklist: A Step-by-Step Guide For Buyers And Sellers

House prices in 2024. Is it the right time to buy a home?

Impact of interest rate hikes on the property market Typically, when the Reserve Banks raise interest rates, it leads to… Continue reading House prices in 2024. Is it the right time to buy a home?

Buying Land in Victoria in 2024? Tax Changes That are Essential to Understand

The landscape of taxation laws underwent a significant transformation in Victoria, Australia recently with the enactment of the State Taxation… Continue reading Buying Land in Victoria in 2024? Tax Changes That are Essential to Understand

Why Do You Need a Conveyancer Before Making an Offer on a Property?

Are you planning to buy a property? Are you aware of the major role a conveyancer plays in this process?… Continue reading Why Do You Need a Conveyancer Before Making an Offer on a Property?

What is a good Credit Score in Australia?

A credit score is a numerical reflection of your financial health in the financial landscape, and it holds the key… Continue reading What is a good Credit Score in Australia?

Mortgage Stress & the Current Housing Market in Australia

Australia has experienced significant fluctuations in its housing market over the last few years, with periods of rapid price increase,… Continue reading Mortgage Stress & the Current Housing Market in Australia

A New Horizon: Introducing Credit Hub’s Islamic Financing

In an exciting development, Credit Hub Australia is proud to announce the launch of its new Islamic finance product tailored… Continue reading A New Horizon: Introducing Credit Hub’s Islamic Financing

The Power of Working Capital Loans: Fueling Business Growth

Running a successful business requires a delicate balance of vision, strategy, and financial stability. While having a solid business plan… Continue reading The Power of Working Capital Loans: Fueling Business Growth

A Complete Guide to First Home Buyers Schemes in Australia

Buying your first home can be a daunting experience and expensive investment, but thankfully there are several Government initiatives in… Continue reading A Complete Guide to First Home Buyers Schemes in Australia

Smart Ways to Manage Your Finances

In the current scenario with the inflation and the series of interest rate hikes in Australia by the Reserve Bank… Continue reading Smart Ways to Manage Your Finances

Refinancing Benefits Explained : Unlocking Benefits for Owner-Occupied and Investment Properties

Refinancing your home loan Refinancing can be a smart move for homeowners looking to reduce their debt, unlock cash from… Continue reading Refinancing Benefits Explained : Unlocking Benefits for Owner-Occupied and Investment Properties

Commercial Loans and Private Funding in Australia : How Credit Hub Can Help

Exploring Your Financing Options If you're interested in investing in commercial property in Australia, securing financing is a key consideration.… Continue reading Commercial Loans and Private Funding in Australia : How Credit Hub Can Help

Choosing Between a Solicitor and a Conveyancer

Why do I need a Solicitor or a conveyancer? Solicitor and conveyancers are legal professionals specialized in handling real estate… Continue reading Choosing Between a Solicitor and a Conveyancer

Refinancing Your Home Loan

The last two years have been tumultuous in so many ways. While the COVID-19 pandemic has wreaked havoc on “normal,”… Continue reading Refinancing Your Home Loan

How Do I Find The Right Mortgage Broker To Apply A Home Loan?

Mortgage brokers are qualified and licensed professionals who specialise at doing home loan comparisons and finalise the best deals for… Continue reading How Do I Find The Right Mortgage Broker To Apply A Home Loan?

Asset and Equipment Finance

Starting a new business is exciting time for most of us. One of the most important things while starting a… Continue reading Asset and Equipment Finance

Key Advantages of Professional Mortgage Brokerage Service

Financial institutions undergo drastic changes to prepare for future challenges as the mortgage industry navigates through another round of economic… Continue reading Key Advantages of Professional Mortgage Brokerage Service

A Guide to Professional Services Banking

What is professional services banking? Professional services banking is industry-specific banking services offered to professionals from some industries like specialised… Continue reading A Guide to Professional Services Banking

How to Choose The Best Mortgage Broker?

A mortgage broker is an independent person who assists prospective homebuyers in obtaining the best rate when obtaining a home… Continue reading How to Choose The Best Mortgage Broker?

How To Choose A Reputable Mortgage Broker?

An essential financial decision you will make in your life will likely be choosing a mortgage, which can also be… Continue reading How To Choose A Reputable Mortgage Broker?

Commercial Property & Commercial Loans Refinancing

What are Commercial Loans? Commercial loans are for buying commercial properties, for commercial developments, commercial assets, and businesses. Commercial loans… Continue reading Commercial Property & Commercial Loans Refinancing

Do I need a Conveyancer? FAQs on Conveyancing

What is Conveyancing? Let us have a look at what is conveyancing before moving to the essential details of why… Continue reading Do I need a Conveyancer? FAQs on Conveyancing

Choosing a Mortgage Broker Vs Bank

Should you go to a broker or directly to a lender? This is the first question that might come to… Continue reading Choosing a Mortgage Broker Vs Bank

Effects of Interest Rate Rise on Property & General Life, Income & Expenses

A key role of the RBA is to conduct monetary policy to keep economic growth in check, achieve price stability, and manage economic fluctuations.

A Guide to Property Development Loans

Property development loans are specialised in nature and are different from residential loans you might be familiar with. You can either apply for a residential or a commercial property development loan depending on the nature of your project.

Statistics: Unemployment Rate Predicted to Fall in 2022

Two years into the pandemic, the economy is in good shape, and set to strengthen in the months ahead. … Continue reading Statistics: Unemployment Rate Predicted to Fall in 2022

A Minimalist Guide To Conveyancing in Victoria

Before we go ahead with all the nitty-gritty details of conveyancing in Victoria, let us first understand what conveyancing is.… Continue reading A Minimalist Guide To Conveyancing in Victoria

Renovation Planning Guide: 5 Things You Must Know

The Federal Government is giving eligible Australians $25,000 to build or substantially renovate their homes, and that’s why a lot Australians want to take advantage of this chance and dive into the renovation process straightaway. Whether you’re planning on renovating for more property value or are aiming to transform your house into the dream house, any type of renovation is a monumental task and can be really stressful.

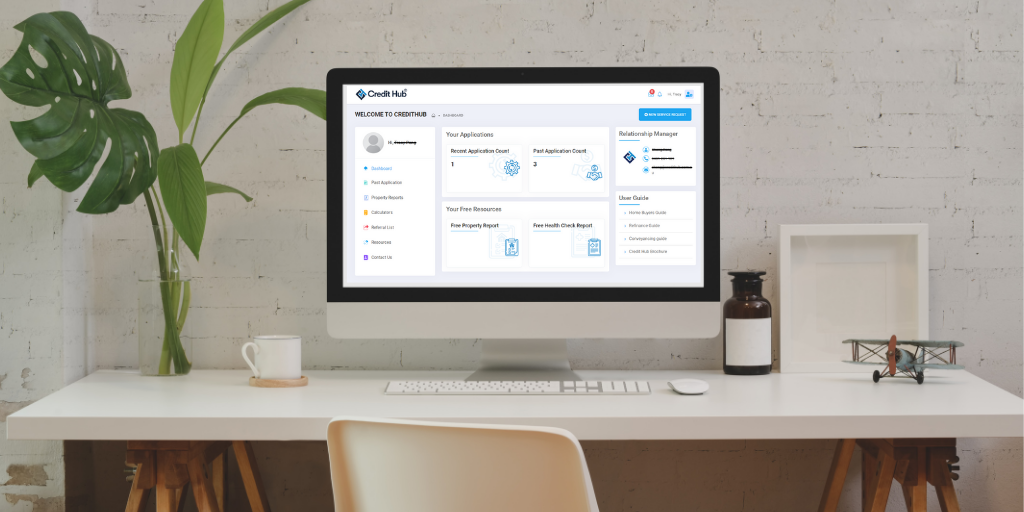

Credit Hub Customer Portal

A lot has changed at Credit Hub in the last year. A re-brand, big service change as we continue to… Continue reading Credit Hub Customer Portal

FREE Loan Health Check by Credit Hub

At Credit Hub, We’re here to make your loan experience as great as possible with our service-oriented approach and advanced… Continue reading FREE Loan Health Check by Credit Hub

Should You Refinance in 2021?

A lot of people asked the question that “should you refinance in 2021? Refinancing your home loan can do more… Continue reading Should You Refinance in 2021?

Do I Need A Conveyancer Before Making An Offer?

Before we go ahead with explaining why you need an experienced conveyancer before making an offer, Let’s first understand what… Continue reading Do I Need A Conveyancer Before Making An Offer?

How To Pick The Right Broker For Your Mortgage Dilemma

How To Pick The Right Broker For Your Mortgage Dilemma Before you go out picking a home loan that is… Continue reading How To Pick The Right Broker For Your Mortgage Dilemma

Important Refinancing Facts You Should Know

Refinancing means paying out the current home loan by taking a new loan with the existing lender or a new… Continue reading Important Refinancing Facts You Should Know

The great advantages of buying vacant land

The great advantages of buying vacant land is often overlooked by many property buyers. While as a matter of fact,… Continue reading The great advantages of buying vacant land

Should I access my super early during the Coronavirus?

If you’re adversely financially affected by COVID-19, such as lost work or being redundant, you may be eligible to access… Continue reading Should I access my super early during the Coronavirus?

How healthy is your home loan?

Bodies’ are not the only thing you should have checked regularly, you should think the same way about your financials… Continue reading How healthy is your home loan?

5 ideas to diversify your income streams

When it comes to your income, everyone just wants to have more than they do. This wish is perfectly normal,… Continue reading 5 ideas to diversify your income streams

Should I buy a property during the COVID-19 pandemic or wait ?

Is now a good time to buy a property? Should I buy a property during the COVID-19 pandemic or wait?… Continue reading Should I buy a property during the COVID-19 pandemic or wait ?

Do You Know How Much You Could Save By Refinancing?

I believe you have heard people talking about the good reasons to refinance. Refinancing your home loan can be a… Continue reading Do You Know How Much You Could Save By Refinancing?

Do you know the hidden costs of buying a home?

Do you know the hidden costs of buying a home? When buying a property the contract price isn’t all you… Continue reading Do you know the hidden costs of buying a home?

Home Builder, What you need to know

If you have been thinking about building a new home or renovating on your current home, now might be the… Continue reading Home Builder, What you need to know

Should I Buy A Car At The End of Financial Year?

If you’ve been thinking about should I buy a car at the end of the financial year, now is the… Continue reading Should I Buy A Car At The End of Financial Year?

What To Consider When Purchasing a Residential Property

Buying a property is a big decision. It is probably one of the biggest purchases in your life, and it… Continue reading What To Consider When Purchasing a Residential Property

It’s Time For A financial Health Check-Up!

If you find yourself with no saving, no job, a credit card debt and no idea where your money has… Continue reading It’s Time For A financial Health Check-Up!

6 tips to save money on your home loan

Buying a home requires the biggest financial commitment most people will ever make during their lifetime. Of course, the loan… Continue reading 6 tips to save money on your home loan

Why You Should Consider Refinancing Your Home Loan During Covid-19

Ever wonder what is the right move during the COVID-19 crisis? Worry about loans and repayments? Credit Hub is here… Continue reading Why You Should Consider Refinancing Your Home Loan During Covid-19

Guide to COVID-19 Relief Package

Information and services to help you if you’re affected by Coronavirus (COVID-19) or looking for more details, here’s a snapshot… Continue reading Guide to COVID-19 Relief Package

5 Ways To Improve Your Credit Score

Your credit score is a number based on your history of borrowing and repayments that helps lenders work out how… Continue reading 5 Ways To Improve Your Credit Score

5 Reasons Refinancing Saves Your Money

Have you ever thought about refinancing and how it can help structure your finances in a better manner, leading you towards achieving your goals? 5 reasons why smart people choose refinancing as their go-to option and see how it saves you money.

Thank You Note

THANK YOU! Amidst the Christmas cheer and the New Year excitement, we are taking out a moment to say thank… Continue reading Thank You Note

5 things to keep in mind before planning a holiday

Less than two weeks are left for Christmas and we know how excited you’d be to make the most of… Continue reading 5 things to keep in mind before planning a holiday

How to Find the Right Property Manager for your Investment Property

Hiring someone to manage your investment property is as important as choosing the right property to invest in. With the… Continue reading How to Find the Right Property Manager for your Investment Property

Questions That You Need to Ask Your Conveyancer

Property investment can be one of the most important investments you make in your life. With the real estate sector… Continue reading Questions That You Need to Ask Your Conveyancer

5 Potential Benefits of Investing in Mortgage Funds

What are mortgage funds? Before we talking about the 5 potential benefits of investing in mortgage funds. Let’s be familiar… Continue reading 5 Potential Benefits of Investing in Mortgage Funds

What is a Mortgage Offset Accounts and How Can it Save More Money on Your Mortgage

How much do you know about offset accounts? Let us first begin with a brief explanation and then move ahead… Continue reading What is a Mortgage Offset Accounts and How Can it Save More Money on Your Mortgage

When is the right time to Switch Mortgage Providers?

After having been with your current mortgage provider for some time now, it’s only natural for you to wonder whether… Continue reading When is the right time to Switch Mortgage Providers?

How Can Parents Help Their Child Buy a First Home Without Risking their Financial Security

Helping your child with getting a home loan for buying a house for the first time comes with its benefits… Continue reading How Can Parents Help Their Child Buy a First Home Without Risking their Financial Security

Home Loan for Self Employed – What Do I Need To Know?

If you are planning to buy a home and are self-employed, irrespective of how much you earn as a regular… Continue reading Home Loan for Self Employed – What Do I Need To Know?

How to Buy Property Off your Self-Managed Super Fund

Buying a property off your Self Managed Super Funds (SMSF) is a common trend among Australians, and has been popular… Continue reading How to Buy Property Off your Self-Managed Super Fund

What is Income Protection and How Does it Work?

For those of us who have a limited understanding of income protection insurance, there are many questions that need to… Continue reading What is Income Protection and How Does it Work?

Why it’s Advisable to Make Extra Mortgage Repayments

It’s a great feeling to own a home, but making payments on the mortgage every month for the next many… Continue reading Why it’s Advisable to Make Extra Mortgage Repayments

Things you Should Know About Home Loan Pre-Approvals [Infographic]

[vc_single_image source=”external_link” title=”Infographic” custom_src=”https://credithub.com.au/things-know-home-loan-pre-approvals-infographic/’>

How Important is The School Zone For Property Value

How much difference, do you think, a school zone could make to the value of your property? When we talk… Continue reading How Important is The School Zone For Property Value

Things to Know Before Taking Out a Small Business Loan

If you own a small business, at some point of time you will require a business loan either to expand… Continue reading Things to Know Before Taking Out a Small Business Loan

Insurance – Inside or Outside Super?

For effective personal insurance cover, you need to consider the levels and types of cover required. Payment of premium tax… Continue reading Insurance – Inside or Outside Super?

Choosing a Home loan – 3 Things to Consider

Everyone knows that purchasing and investing in property is a lifetime commitment. The entire ride can be risky and a… Continue reading Choosing a Home loan – 3 Things to Consider

Things You Need To Know Before Getting a Home Loan

Buying a home for the first time? The daunting challenge of applying for a home loan can prove to be… Continue reading Things You Need To Know Before Getting a Home Loan

6 Ways Women Can Make the Most of their Super Funds

Women have to work harder to make the most of their retirement income. This includes making the best of their… Continue reading 6 Ways Women Can Make the Most of their Super Funds

7 Factors that affect Life Insurance Costs in Australia [Infographic]

When you apply for life insurance, a number of factors come to play. It is not just the series of… Continue reading 7 Factors that affect Life Insurance Costs in Australia [Infographic]

Top 10 Reasons Why Banks Reject Home Loan Applications

Doing your homework before applying for a home loan can reap rich rewards when you approach the bank or financial… Continue reading Top 10 Reasons Why Banks Reject Home Loan Applications

7 Things To Consider When Investing In Property

With real estate prices surging, investing in property has become a profitable and viable proposition. But, you need to look… Continue reading 7 Things To Consider When Investing In Property

The 7 Biggest Retirement Planning Mistakes You Can Make

Retirement planning should never come as an afterthought. It’s not a simple case of paying off mortgages, acquiring a few… Continue reading The 7 Biggest Retirement Planning Mistakes You Can Make

Secrets Revealed: How Australians with Average Incomes Have Built Property Portfolio

Do you have to be a millionaire to have your own investment property portfolio? The answer to that is a… Continue reading Secrets Revealed: How Australians with Average Incomes Have Built Property Portfolio

Melbourne’s Most Affordable Suburbs for First Home Buyers in 2017

The property market in Melbourne is booming. As prices rise, smart home buyers get the edge by choosing the most… Continue reading Melbourne’s Most Affordable Suburbs for First Home Buyers in 2017

![7 Factors that affect Life Insurance Costs in Australia [Infographic]](https://www.credithub.com.au/wp-content/uploads/2017/09/7-Factors-that-affect-Life-Insurance-Costs-in-Australia-Infographic.jpg-1024x536.jpg)