When you apply for life insurance, a number of factors come to play. It is not just the series of questions that are asked regarding your health, occupation, medical history, and lifestyle. So, next time, before you apply for life insurance, it is mandatory to make a checklist to ensure that your application gets through without any road bumps.

It is always better to be absolutely sure about the procedures and requirements rather than wondering why the process must be so difficult to get through. So, here are 7 essential factors that can affect the premium of your life insurance that you need to tick off your checklist to make the process smooth for you.

#1 Age

Your age matters. Taking out life insurance at a younger (eligible) age ensures a lower premium for the prime reason that you are expected to less likely make a claim then.

#2 Gender

Insurance premiums for women are lower than that for men as research suggests that most women live about 5 years longer than men.

#3 Career

What is job all about? Does it involve any risks to your life? High-risks jobs are directly proportional to higher premium rates as insurers believe that you are more likely to make a claim due to the dangers involved.

#4 Lifestyle Habits

Do you smoke or drink? How often do you involve in these habits? You should know that smokers are likely to pay 2-3 times more premium than non-smokers do due to the health hazards involved.

#4 Family Health History

Has anyone in your family been subject to hereditary chronic diseases like cancer, heart problems, Alzheimer’s, diabetes. If yes, your insurance premium is likely to shoot up as this factor puts you at risk of same too.

#5 Existing/ Previous Illnesses

If you have been subject to any type of chronic illness in the past, then that too will result in higher insurance premium rates. However, ensuring your insurance company that you are in control of your illness might help you get a preferred and lower rate.

#6 Driving Record

Reckless driving is a high-alert to insurers or high-risk to your life. Hence, it automatically means a higher premium rate than usual.

Other than these 7 factors, life insurance premiums and costs are also dependant on your and at times, your family’s lifestyle conditions.

Nevertheless, do not worry if your insurance provider asks you probing questions. It’s necessary for insurers to determine your life expectancy to ensure that you will be able to pay your premiums on time. This procedure is meant to help you pay for your family in your physical absence, in case of death.

Your health and lifestyle might undoubtedly be the main factors for insurers to assess your eligibility for the life insurance, yet another important word-of-advice is – “failing to disclose pertinent information can lead the insurer to cancel your policy without refund or deny claims that you might make.”

Some policies may even require you to undergo a complete medical or physical check-up for eligibility. Not all policies will require this, but if you have pre-existing conditions then the insurer might insist. This is to ensure that no condition has been overlooked and to clearly verify your health and wellbeing at the time of application.

Not every life insurance company assesses applicants in the same way. While some companies may refuse to provide cover to high risk applicants, there will be others that are willing to provide cover despite risky occupations, pastimes, medical conditions or lifestyles. Even with these, however, you should still expect additional premium loading or certain exclusions in your policy.

It is always good to be aware of your risk profile, as it relates to the probability rate of how likely you are going to make a life insurance claim before the policy expires.

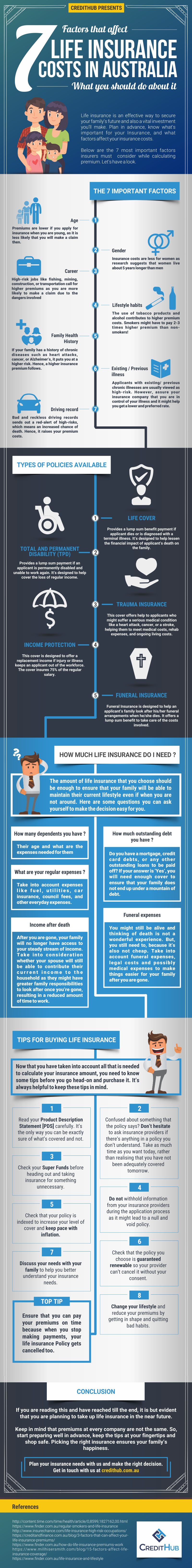

Consider listing all the lifestyle factors, occupational hazards and dangerous pastimes you have which might affect your insurance needs, and then specifically considering how these are handled by different policies. The infographic below will give a much detailed graphical representation of everything needed. So, let us have a look at what it says.

![7 Factors that affect Life Insurance Costs in Australia [Infographic]](https://www.credithub.com.au/wp-content/uploads/2017/09/7-Factors-that-affect-Life-Insurance-Costs-in-Australia-Infographic.jpg.jpg)