Looking for Mortgage Brokers in Epping, VIC?

We'll Help You Get Amazing Rates

At Credit Hub, we help you finance your dreams by making available competitive loans and services. As a one-stop solution for all your financial needs, we strive to deliver 100% customer satisfaction whether it is a home loan, business loan, insurance, financial planning or conveyancing.

Our financial experts work day in and out to carry out all the legwork on your behalf so that your whole experience is hassle-free. With 20 years of experience in the financial industry, our mortgage brokers have equipped themselves with the nitty-gritty of loan services.

We have experts to help you navigate the maze of mortgages in Epping. Finding a great home loan that best suits you is one of our expertise. Our best interest is to help you make better financial decisions to lead a quality life. Discover the best home loan interest rates with our licenced mortgage brokers to fund your dream home.

We offer great rates from as low as

We negotiate better rates with more than 35 lenders for you

The best mortgage brokers work with you, not against you. Contact us today at our office to see why we’re most trusted for over seven years.

We're trusted mortgage brokers in Epping - Here's why

At Credit Hub we have been serving local customers for years, we have learned and dedicated ourselves to always improving and adapting with time. Feel the difference with our service-oriented approach and advanced technology. Our mortgage brokers will strive to get you the best loan available from our network of lenders.

Us

Company founded by experienced banker, over 20 years’ experience in industry. We have team of fully trained accredited dedicated manager and support.

Support

Industry first automated customer service portal and support, Portfolio management by dedicated managers with ongoing account support.

Resources

Experienced team to help you in your need, Free property and Finance heath check for our customers. Latest industry updates and news access.

Extra Repayment

Join the exclusive club and be rewarded discounts on other company services. Cash back rewards for referral program.

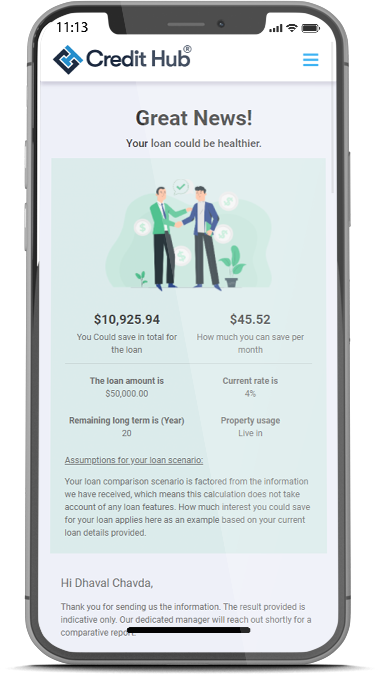

Let's get you pre-qualified

Whether you are looking for new loan or refinancing, it’s now easy to get pre-qualified first. Start qualification check now via our online platform, the fast-simple way to get personalised borrowing proposal in seconds.

- Personalised loan scenario with potential borrowing power

- Fast and simple online process, this will not affect your credit rating

- Our experts are available online to help you if you are stuck.

Our other financing services in Epping

See how other ways we can help you achieve your financial dreams. From Refinancing Loans to Bridging Loans, Credit Hub can help Epping residents to take you where you want to be.

Refinancing Loans

Refinancing your home loan can be a great step to save money with improved loan features such as lower repayments or extra repayments.

Home Loans

Whether you are buying your first home, refinancing or investing, a suitable home loan can provide you with the financial assistance you need.

Personal Loans

Personal loans might seem to be an outdated financial product, but it can assist you especially during a financial emergency.

Construction Loans

Instead of buying an already established home, you may be thinking of constructing a home of your choice.

Bridging Loans

The transition from when you sell your home to buying a new one, you may need a bridging loan to help you.

Our Customers Love What We Do

Customer Reviews

5.0 from 161 reviews

Key facts about Epping, VIC

- Epping is a suburb in located in the northern area of greater Melbourne and is located 20km from the CBD.

- According to the 2016 ABS census, Epping’s population reached 32,395 with the median age of 33.

- All private dwellings were reported at 11,268 houses with the median weekly household income of $1,304.

- The median mortgage monthly mortgage repayments were reported at $1,700, which was lower than the state median ($1,728) and the rest of Australia ($1,755).

Ready to start your home loan in Epping?

Let’s start with a few details, and we’ll

get back to you with a free consultation.